Small Business Outlook and Future Plans

It’s been a challenging year for small businesses. Confidence levels have dipped since 2023, reaching lows not seen since September 2020. Today, 40% of small business owners feel optimistic about the upcoming year—a slight decline from last year, but better than the 20% confidence level back in September 2020.

When we stretch the timeline and ask about the next five to ten years, the numbers aren’t much higher. 39% are positive about the next five years, and only 34% see the next decade positively. These figures have improved slightly in recent months.

However, confidence varies. Bigger businesses seem more hopeful for the next year. Those in industries like agriculture and manufacturing have a brighter outlook, while businesses serving everyday consumers, like restaurants or spas, are a bit more cautious.

Major concerns include:

- Economic changes and supply chain disruptions: These challenges have become more prominent, especially among businesses with significant earnings.

- Hiring challenges: Particularly for businesses earning between $500k and $2.5m annually.

- Rising interest rates: They’ve been affecting more businesses negatively. 41% report a negative impact now, compared to 35% in June 2022.

Navigating the business world has always been a challenge, and the trends of 2023 show that it remains as unpredictable as ever. However, despite the external challenges and shifts in confidence, the resilience and adaptability of small business owners shine through.

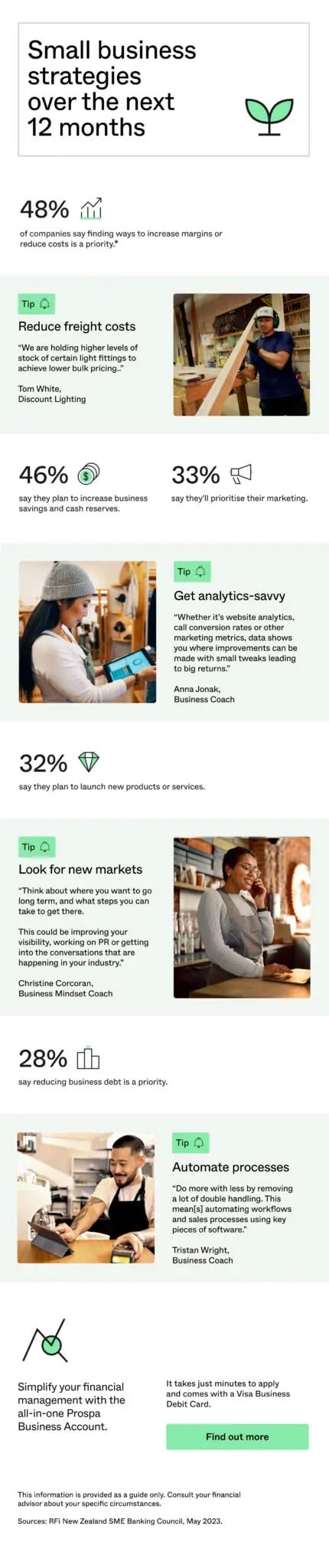

As they plan for the next 12 months, several strategies emerge as top priorities for small businesses:

1. Reduce Freight Costs: Logistics can be a significant expense. By streamlining operations and holding higher levels of stock for specific items, businesses can mitigate these costs.

2. Get Analytics-Savvy: In today’s digital age, understanding data and analytics is paramount. Interpreting metrics, such as call conversion rates, can illuminate areas of improvement and growth.

3. Look for New Markets: Expanding horizons and tapping into new customer bases can provide avenues for increased revenue and brand reach.

4. Automate Processes: Embracing technological advancements not only streamlines operations but also ensures effective resource allocation. Automated workflows and integrating useful software can significantly reduce overheads.

The road ahead may have its challenges, but the spirit of entrepreneurship remains undeterred. The coming months will be pivotal in shaping the trajectory of small businesses amidst a rapidly evolving economic landscape.

Apply for a Small Business Loan

The information in this post is provided for general information only and does not take into account your personal situation. Nothing contained in this post constitutes advice or an endorsement or recommendation of any kind by Trademate. Any links to third party websites are strictly for informational purposes only. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from financial, legal and taxation advisors. Although every effort has been made to verify the accuracy of the information as at the date of publication, Trademate, its officers, employees and agents disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy, or omission from the information for any reason, including due to the passage of time, or any loss or damage suffered by any person directly or indirectly through relying on this information.